-

What is the Value You Bring to the Table?

Showcasing Your Startup’s True Value When raising capital, especially for startups and growth companies, the value proposition must be compelling. As experienced capital raising advisors, we often encounter founders with weak narratives, lacking the clarity and conviction investors seek. No investor will part with their money without understanding the value and potential returns of an…

-

Raising 100M dollars: A Capital Advisor’s Challenge

Mastering investor relations and cultural nuances Raising 100M dollars is a monumental task that places significant responsibility on the shoulders of a Capital Raising Advisor. Clients trust advisors with monthly retainer fees and cover travel expenses, underscoring the importance of their role. Despite extensive due diligence, the advisor cannot fully predict the client’s performance when…

-

Why Some Companies Cannot Raise Funds:

1-They don’t have a clear and professional business plan. 2-Their business plan is poor. 3-Their business model is not sustainable. ……..

-

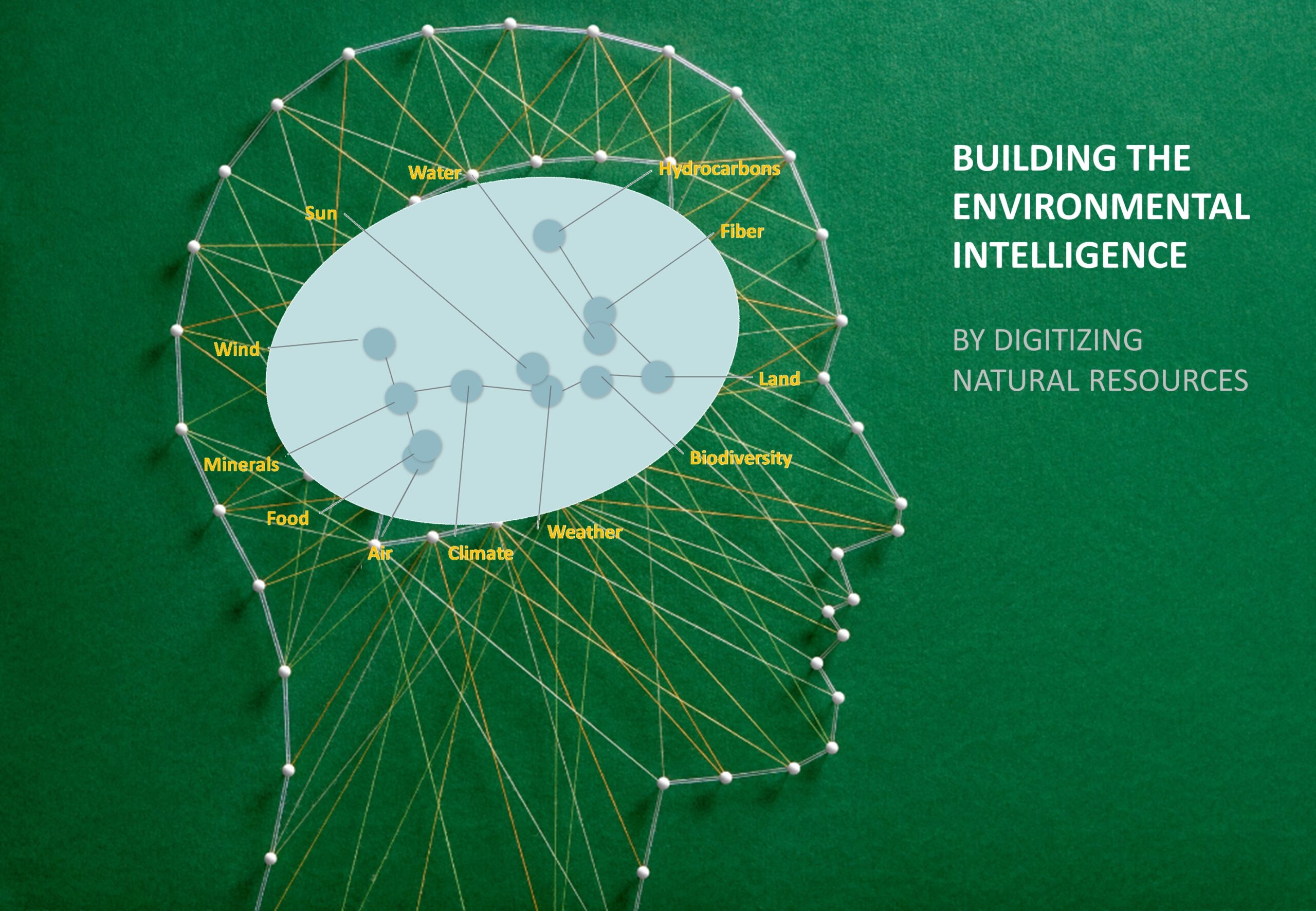

Building Environmental Intelligence

In today’s era of rapid technological advancement, harnessing the power of available technologies is paramount for sustainable development. The fusion of satellite imaging, artificial intelligence (AI), machine learning (ML), and historical data offers a transformative opportunity to create a digital twin mirroring Earth’s vital resources.By leveraging satellite imaging, we can obtain real-time, high-resolution data of…

-

Looking to invest in Tech Projects

We have been entrusted by a renowned family office with the task of sourcing an exceptional tech investment opportunity. Our search spans across various countries, and we are specifically targeting scale-up tech companies that have already established a revenue-generating model. The family office is prepared to invest between USD 1 million and USD 5 million…

-

The Benefits of Private Lenders in Property Development Financing

In the realm of property development financing, private lenders emerge as formidable partners, offering distinct advantages over traditional banks. These advantages encompass flexibility, speed, creativity, and personalized service, making private lenders an attractive option for developers navigating the complex landscape of project funding.Private lenders boast flexible lending criteria, unshackled from the stringent regulations binding traditional…

-

Rethinking Pedagogy using Digital Resources

The use of technology in education has been a topic of discussion for many years, with the hope that it can revolutionize learning and improve student outcomes. While digital resources have been reported to increase student motivation and engagement, evidence of their impact on student learning is still limited. It is essential to rethink pedagogy…

-

Closed Doors, Lost Opportunities:The High Price of Inaccessible Investors

In the dynamic landscape of investment, the disconnect between innovative ideas and accessible investors persists. Many promising ventures struggle to bridge this gap, encountering closed communication channels and missed opportunities. Despite claims of investment appetite, numerous firms remain elusive, relying on impersonal forms or inaccessible contact information.This discrepancy raises critical questions about the efficacy of…

-

Beyond AI Templates: Crafting Original Narratives for Pitching Success

In the world of fundraising, clients often seek my assistance in securing funds for their ventures. Surprisingly, many lack a coherent story, prompting extensive discussions to unearth the essence of their vision. Once armed with sufficient details, I delve into thorough market and product research.The heart of my role lies in constructing a compelling narrative,…